What is a Risk Retention Group (RRG)?

March 24, 2025

A Risk Retention Group (“RRG”) is NOT an Insurance Company

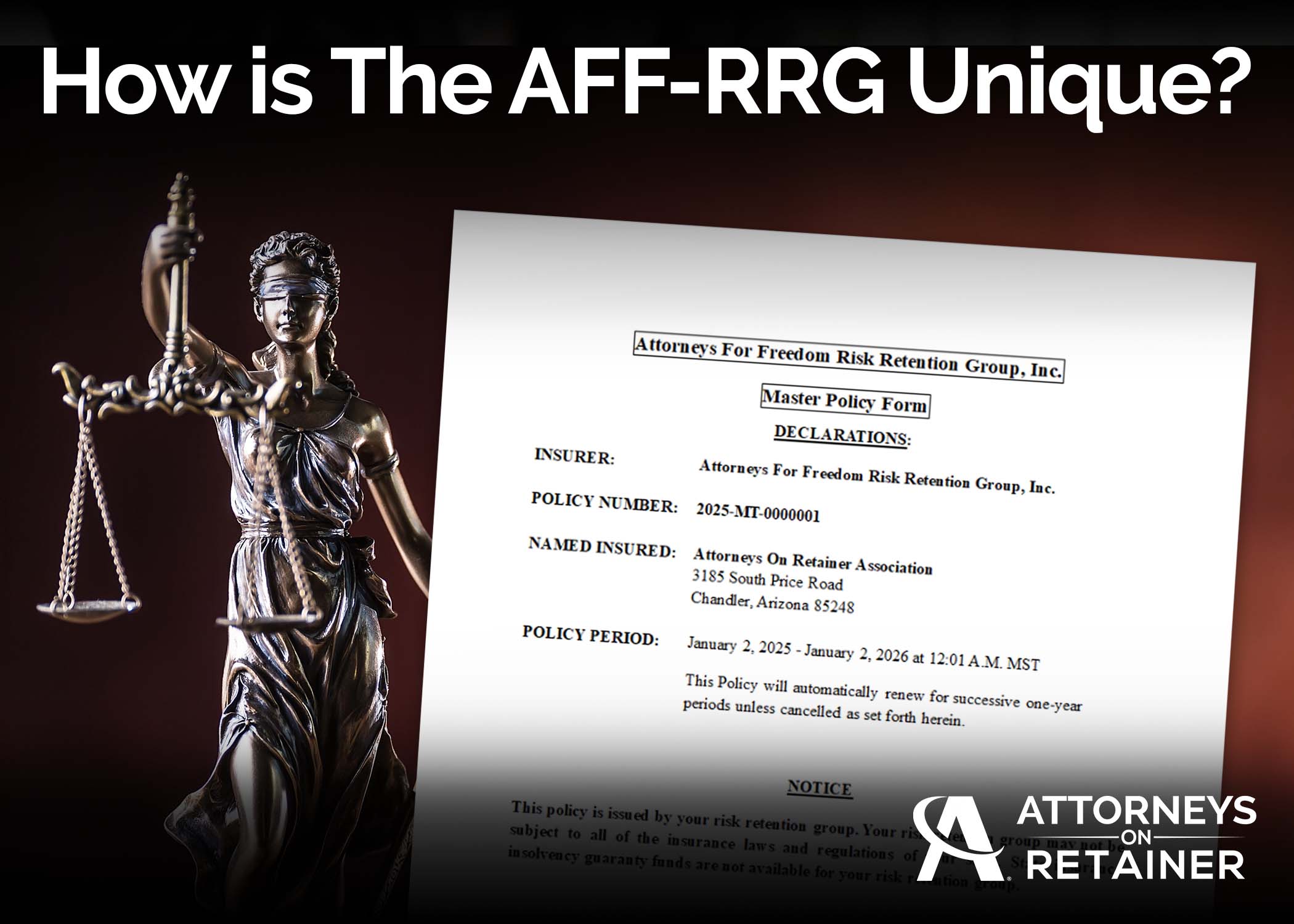

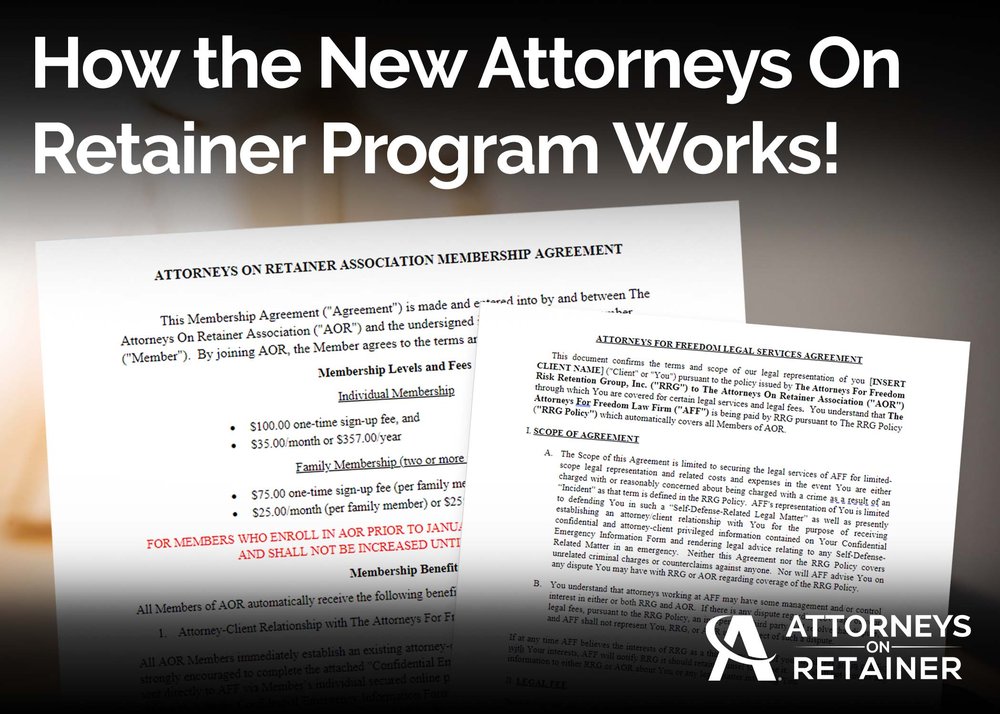

An RRG is not an insurance company. Instead, it is a unique legal entity formed pursuant to federal law, offering an alternative way to handle risk and liability. Instead of associating with a traditional insurance company involving insurance-conducted claims processes, standard insurance policy exclusions, transfers of private information, loss of attorney-client privilege, and strict state-by-state regulations, The Attorneys For Freedom Law Firm created and formed The Attorneys For Freedom Risk Retention Group Inc. (“AFF-RRG”).

AFF-RRG was specifically created and is carefully calibrated to serve the needs of affiliates who join The Attorneys On Retainer Association. Drafted to encompass and enumerate a list of circumstances that are NOT excluded from coverage such as criminal acts, sensitive places, illegal weapons, prohibited possessor status, domestic violence, and alcohol or drug use, AFF-RRG’s Policy is unique. All affiliates of The Attorneys On Retainer Association, whether individuals or business entities are automatically protected against a host of different risks by the AFF-RRG Policy.

Unlike traditional insurance companies, which are strictly regulated by each state in which they do business, RRGs are carefully regulated by only one state and authorized to write policies to their affiliates residing in any state that has been provided notice by the RRG. The AFF-RRG was carefully and thoroughly vetted for compliance with all laws and financial solvency, using a host of experts including accountants, actuaries, and other regulatory professionals in the state of Montana. As such, The AFF-RRG is now authorized pursuant to federal law to do business in all fifty states.

A Brief History: How Did RRGs Come About?

Having recently been created, Risk Retention Groups were dramatically expanded as a response to a growing issue faced by doctors in the 1980s. Doctors were struggling with skyrocketing malpractice insurance costs and limited coverage options. To solve this problem, Congress passed, and then President Ronald Reagan signed the Liability Risk Retention Act of 1986 at 15 U.S.C. § 3901 et seq., which allowed groups of professionals, like doctors, to form their own risk pools and protect themselves. This idea has since evolved and expanded beyond the medical field, offering a unique solution to discrete groups seeking to insure themselves without the usual exclusions of traditional insurance or the regulatory burden of complying with the insurance regulations in each state.

How Does a Risk Retention Group Work?

Unlike traditional insurance companies that must strictly comply with the individual regulations in each state in which they do business, an RRG is regulated by only one state—its chartering state. RRGs can only offer their private insurance to affiliates who are members of a particular group. In the case of AFF-RRG, it can only issue policies to affiliates who join The Attorneys On Retainer Association.

The AFF-RRG was carefully formed in Montana in compliance with all laws and regulations. Montana’s Commissioner of Securities and Insurance thoroughly vetted the AFF-RRG for financial stability, compliance with both state and federal regulations, and the proper financial reserves to ensure that it can meet its obligations. MT has a continuing duty to ensure that AFF-RRG continues to maintain financial stability and to comply with all requirements of MT law, federal law, and the mandates of The AFF-RRG.

Why Did We Choose Montana?

Not all states allow RRGs to be formed. However, Montana has a reputation for excellence in forming and administering successful RRGs. The regulators in MT are well-experienced in all aspects of forming and administering RRG law. Additionally, of the available states to form RRGs, many are not friendly to firearms and self-defense issues.

Montana is a state known for valuing freedom and individual rights. The MT professional regulators have always maintained and expressed great interest and excitement for collaborating with The Attorneys For Freedom Law firm to carefully form AFF-RRG to be in compliance with all aspects of all laws and regulations. MT’s Commissioner of Securities and Insurance employed independent actuaries and financial experts to ensure that AFF-RRG is financially stable and compliant with all regulations. All parties involved remain committed to ensuring AFF-RRG remains in full compliance with all aspects of relevant laws and regulations.

Conclusion

In conclusion, for a variety of reasons, an RRG was the best option to provide all the benefits of what is offered by a traditional insurance company without any of the serious downsides. It allows The Attorneys On Retainer Association to offer private insurance to all affiliates which protects against a variety of different risks in all fifty states.

All Attorneys On Retainer affiliates now automatically receive all the benefits offered by The Attorneys On Retainer Association as well as the coverage offered by AFF-RRG. They all maintain strict attorney-client privilege with The Attorneys For Freedom Law Firm because they are clients of the law firm as well as affiliates of The Attorneys On Retainer Association. With the combination of being an affiliate of The Attorneys On Retainer Association as well as a client of The Attorneys For Freedom Law Firm, The AOR Program is unrivaled in the marketplace. We are proudly the best in brand and intend to stay that way by being committed to excellence in all we do.

For more information on why we chose to form an RRG instead of associating with traditional insurance, visit:

To learn about what makes the AFF-RRG unique, visit:

Join Attorneys On Retainer and prioritize your self-defense rights today!

Ready to upgrade as a member or primary account holder? Check your email for your unique code to get started. If you have not received it, contact support@attorneysonretainer.us.